How Much Is Self Employment Tax In 2025

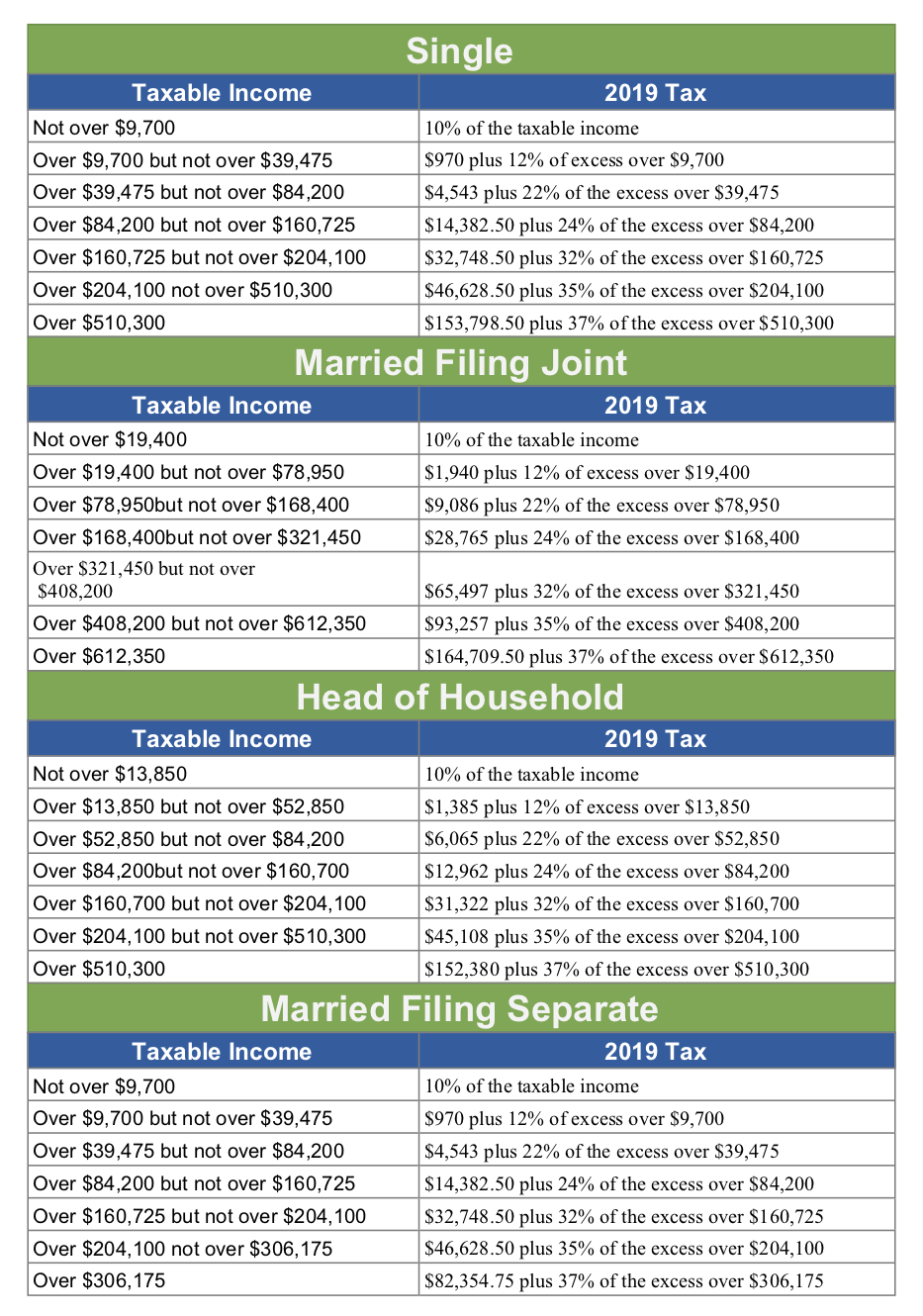

BlogHow Much Is Self Employment Tax In 2025. You will pay a 12.4% tax on the first $168,200. Employee’s portion of social security tax for 2025 was 6.2%.

This tax is divided into two parts, as follows: Enter your estimated weekly or monthly profit to get an idea of how.

You don’t have to make the payment due january 16, 2025, if you file your 2025 tax return by january 31, 2025, and pay the entire balance due with your return.

A Beginner's Guide for SelfEmployment Tax TaxSlayer®, This rate is divided into two parts: How much of your income falls within each tax band;.

Fastest SelfEmployment Tax Calculator for 2025 & 2025 Internal, This rate is divided into two parts: You don’t have to make the payment due january 16, 2025, if you file your 2025 tax return by january 31, 2025, and pay the entire balance due with your return.

How to Calculate SelfEmployment Tax Four Pillar Freedom, High income individuals may be assessed. How much of your income is above your personal allowance;

How to File SelfEmployment Taxes, Step by Step Your Guide, What is self employment tax rate for 2025 & 2025? You pay this tax on all wages, tips, and net earnings from.

How is selfemployment tax calculated?, You pay this tax on all wages, tips, and net earnings from. For 2025, the first $168,600 of earnings is subject to the social security portion (up from $160,200 in 2025).

Understanding the SelfEmployment Tax, You don’t have to make the payment due january 16, 2025, if you file your 2025 tax return by january 31, 2025, and pay the entire balance due with your return. This figure is the combined total of two distinct components as discussed above.

Understanding selfemployment taxes as a freelancer Tax Queen, This tax is divided into two parts, as follows: However, you do not have to pay any social security tax on the.

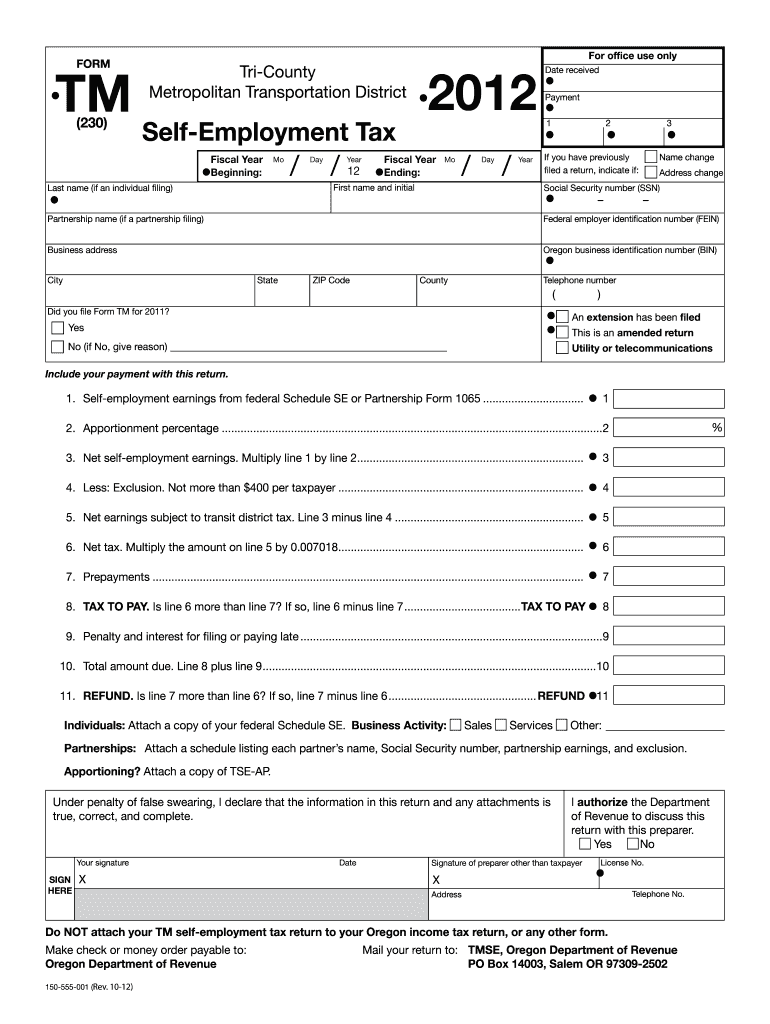

Self employment tax Fill out & sign online DocHub, If you are able to. This tax only applies to.

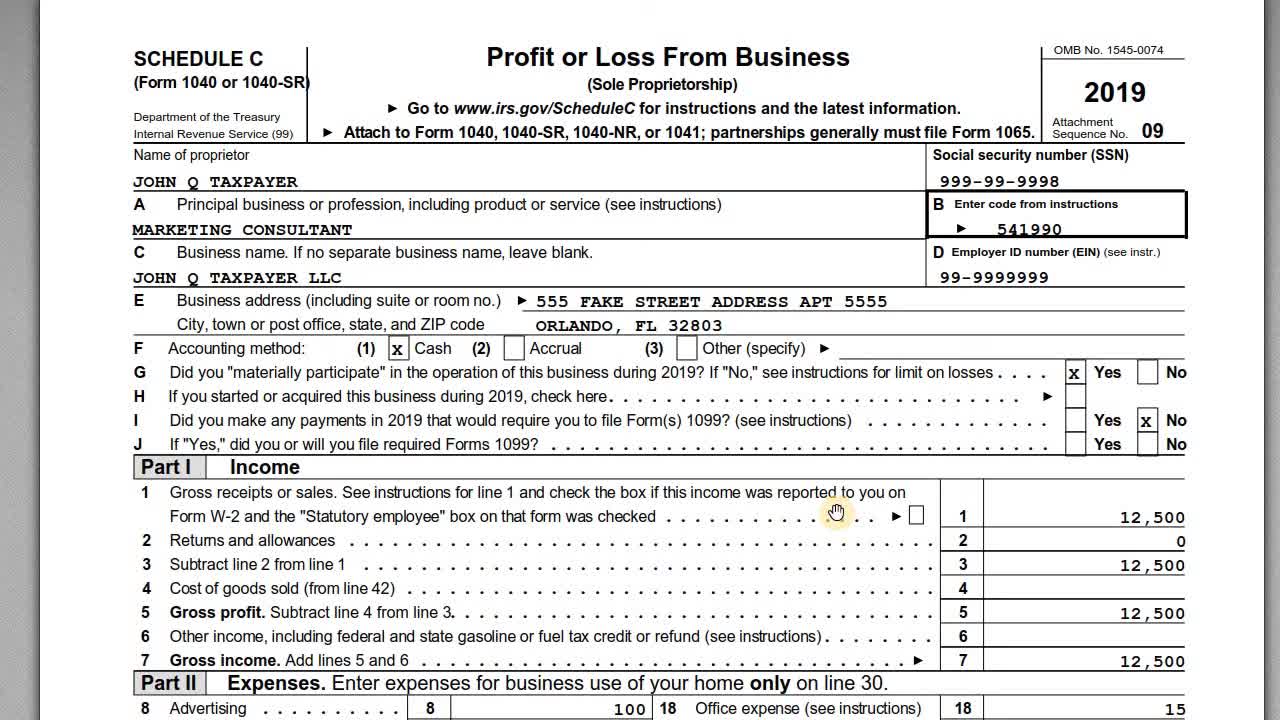

IRS Schedule C with Form 1040 Self Employment Taxes, How much of your income is above your personal allowance; If you are able to.

How Much Can I Contribute To My SelfEmployed 401k Plan?, You don’t have to make the payment due january 16, 2025, if you file your 2025 tax return by january 31, 2025, and pay the entire balance due with your return. But note that social security.

You don’t have to make the payment due january 16, 2025, if you file your 2025 tax return by january 31, 2025, and pay the entire balance due with your return.