2025 Social Security Tax Limit Capex

Blog2025 Social Security Tax Limit Capex. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. So, if you earned more than $160,200 this last year, you didn't have to pay the social security.

For earnings in 2025, this base is $168,600. Deduction of expenditure by employers towards nps to be increased from 10 to 14 per cent of the employee’s salary.

Social Security Tax Limit 2025 All You Need to Know About Tax Limit, The wage base or earnings limit for the 6.2% social security tax rises every year.

Social Security Tax Limit 2025 Withholding Calculator Kimmy Merrile, For earnings in 2025, this base is $168,600.

What Is The Annual Limit For Social Security In 2025 Harli Magdalena, Deduction of expenditure by employers towards nps to be increased from 10 to 14 per cent of the employee’s salary.

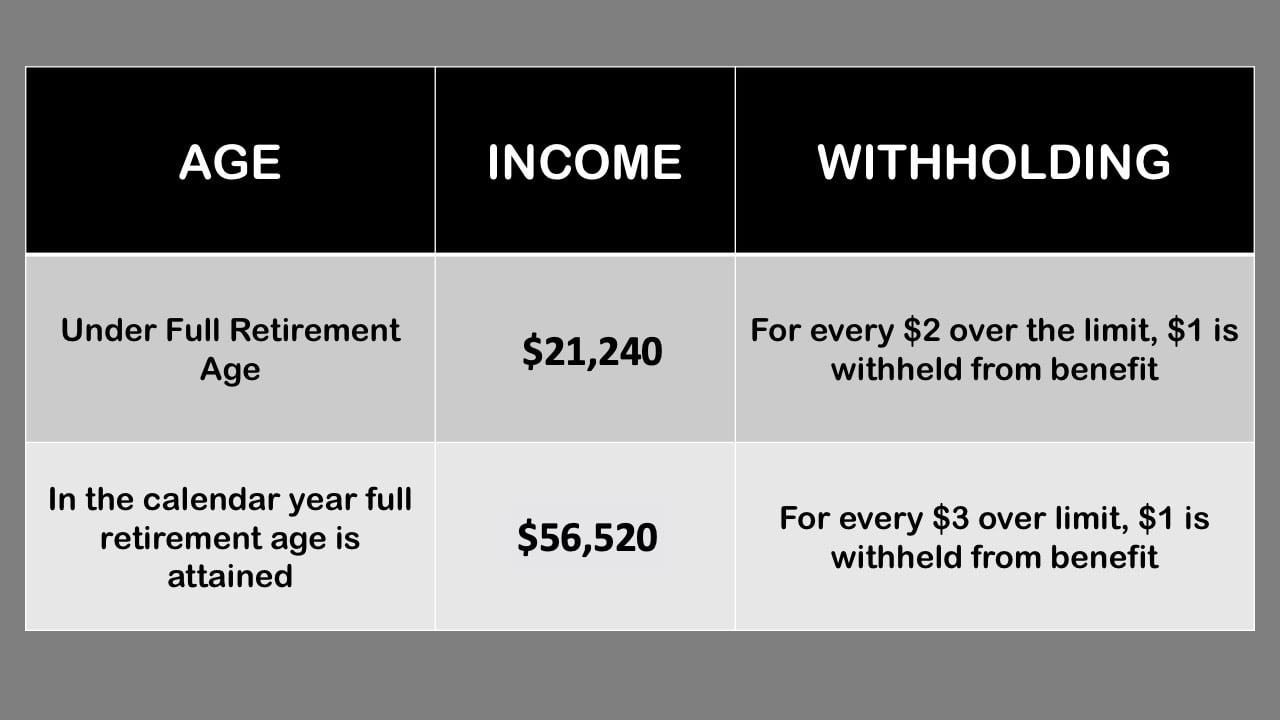

Social Security Tax Limit 2025 Know What Social Security Tax Limits in, The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

2025 Social Security Tax Limit Cap Reba Brigitte, In 2025, the social security tax limit rises to $168,600.

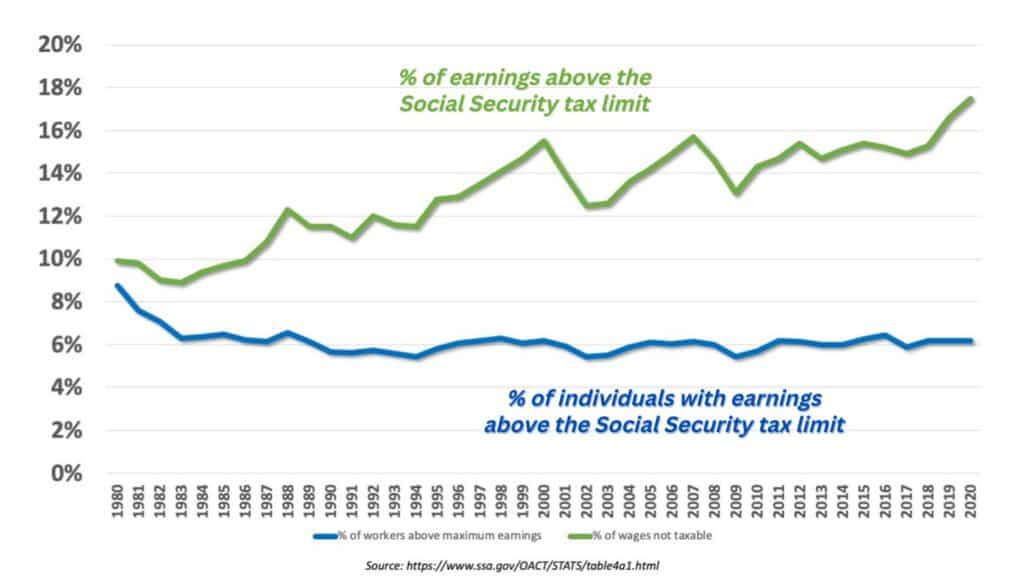

2025 Social Security Tax Limit Increase Marji Shannah, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.

Social Security Tax Limit 2025 Increase Over 50 Sena Xylina, The 2025 and 2025 limit for joint.

Social Security Tax Limit 2025 Pdf Dasya Emogene, For earnings in 2025, this base is $168,600.